Are your relationship teams winning new hedging business right now?

Digital Advisory Sells.

Go online, showcase a product story. Give clients a try.

One platform for bank and bank clients, automating solution delivery at scale.

Start your 30 day free trial. Your trial expires automatically. No payment method or credit card.

From connected instrument and risk exposure data,

to data driven digital advisory and timely bank solutions.

Safeguard your corporate clients' financial

positions against unfavourable interest rate or

currency movements.

Optimize operations and improve customer experience with timely insights and integrations in systems that you and your clients already use. emformX is the easiest way to make lasting impact in data driven client coverage.

OTC INSTRUMENT MONITORING

Timely multibank financial instrument information from a single interface and trusted integration.

Also available via Fusionfabric.cloud

DIGITAL ADVISORY PLATFORM

The right product for each client’s individual needs starts with connected and forward looking multibank instrument and risk exposure information.

Also available via Fusionfabric.cloud

Instrument coverage for corporate banking

emformX integrates following financial instrument categories onto cloud platform, enabling easy embedding of instrument data along the bank and bank clients workflows.

Loans

Interest Rate Derivatives

Currency exposure

Foreign Exchange Derivatives

Built with leading partners:

Digital Advisory Platform

emformX solution offers relationship banker cloud based digital advisory across all the corporate clients multibank positions: loans, foreign exchange, interest rate and currency hedges with the bank and with other banks.

Higher client retention through digital advisory

Teaming up with us, banks can roll-out digital corporate sales, let the technology to win new leads and accelerate clients understanding for products making most sense right now. Enabling client self service in real-time, from every device, 24/7. Saving millions of working hours and kilometers of useless driving for personal meetings.

Track key developments

Gain instant overview of qualified opportunities, when markets or client preferences change. Hover around recommendations or likely banking solutions and use it for client interaction. Bank teams working on the same data foundation, will understand the clients banking patterns faster and thereby transforming the speed, from identifying opportunities to deal fulfillment, to a new level. AI opens a world of new opportunities

Nurture.Personalize.Win!

Maximize data synergies from sample trade ideas to basic holdings with the bank and bank only advisory, to fully integrated multi-bank positions and corporate self-service. Easily communicate the features and benefits of recommended loan structure, foreign exchange or interest rate hedges. A cloud foundation to nurture most qualified leads in corporate banking towards conversion.

Client self service

Same platform enables companies independent access to re-use data shared by the financial institutions or work with own unique instrument data. Perform relevant treasury tasks in self service including forecasting cash-flows from corporate loans, plan liquidity in base or foreign currencies, mitigate interest rate and foreign exchange risks with smart hedging, anytime when business or markets change.

Benefits

Increase revenue

Higher interaction frequency leads to immediate revenue generating results

Improve efficiency

Faster and comprehensive access to instrument data

Reduce risk

Timely access and automation of compliance tasks reduces risk

Reduce cost

Collaborating on the same data, the cost of new data drops, the value of data increases over time

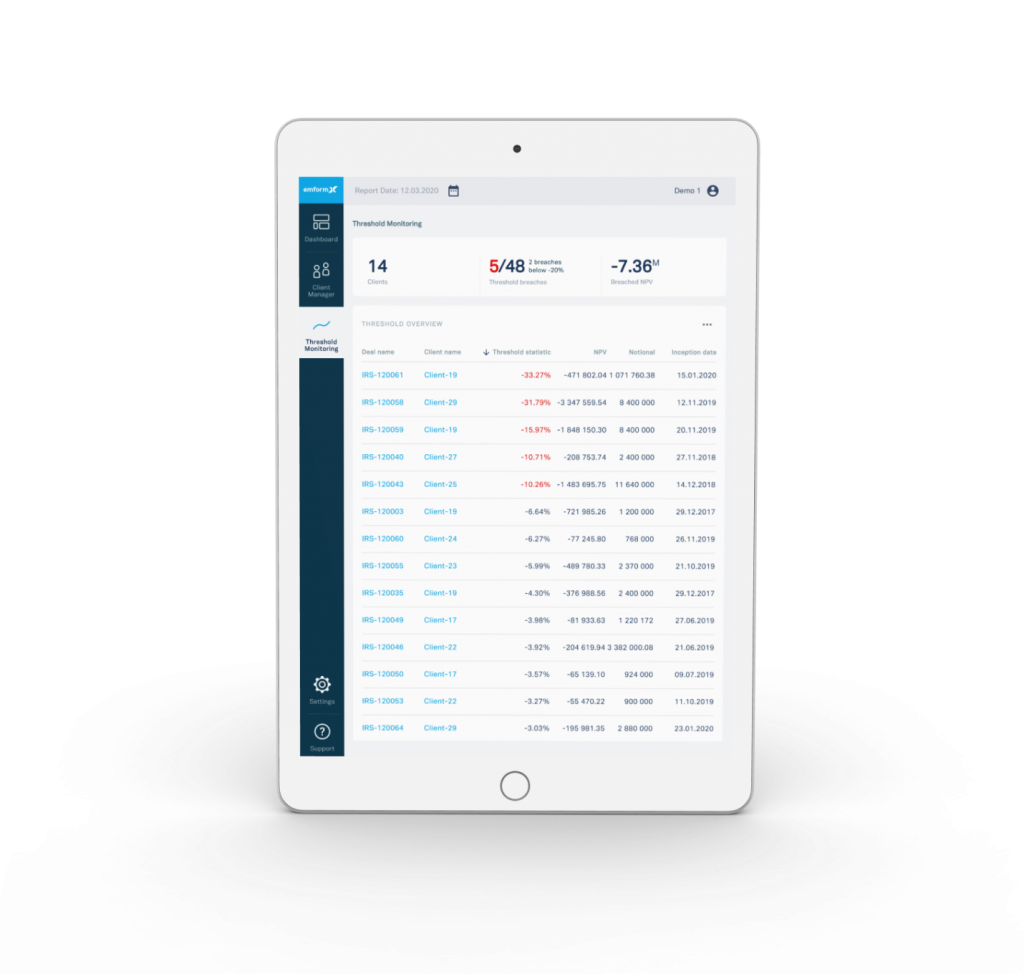

OTC Instrument Monitoring

emformX offers bank teams cloud based interest rate and currency derivatives monitoring by position valuation, risk and compliance aspects. Easy to use app simplifying client coverage on instrument by instrument or on a portfolio level, anywhere and just in time when financial markets move.

All from one integration.

Timely instrument monitoring capabilities

Cloud service environment enabling timely views on clients OTC instruments and other banking products positions data with the bank, supporting collaborative work within bank teams.

Break bare minimum delivery

Fast deployment, bank teams can start working on actionable and higher frequency instrument information, in contrast to bespoke spreadsheets or delayed and fragmented data from different bank systems.

Synergies from combined data re-usage

Uniting bank data from different sources, emformX insights and financial markets data, lead to strong combined data driven business capabilities

Benefits

Increase revenue

New deal opportunities from timely instrument management

Improve efficiency

Faster and comprehensive access to instrument data

Reduce risk

Timely access and automation of compliance tasks reduces risk

Reduce cost

Collaborating on the same data, the cost of new data drops, the value of data increases over time

Technology

Secure, open and hyperscalable, multiple access point – Cloud, Mobile and Rest API-delivery of services

New digital ventures

emformx takes corporate banking to a new level

RESTFUL-API

SANDBOX

TESTED DATA MODEL

PREINTEGRATED MARKET DATA

Request a demo

Book time with our team to see emformx products in action

© 2007-2024 emformX GmbH. All rights reserved.